Unemployment tax break calculator

It starts at a 15 rate and rises with your income up to 33. Lunch or break room 75 square feet plus 25 square feet per person seated Conference room 50 square feet plus 25 square feet per person seated Dont forget to think of other specialty areas particular to your operations.

Llc Tax Calculator Definitive Small Business Tax Estimator

United States Salary Tax Calculator 202223.

. It starts at a 15 rate and rises with your income up to 33. Cyclical unemployment is a type of unemployment which is related to the cyclical trends in the industry or the business cycle. Cyclical unemployment relates to the business cycle in an industry.

Is not a state but it has its own income tax rate. Federal tax which is the money youre paying to the Canadian government. UK Tax.

From a monthly income of 950 Euro gross wage taxes are due. Get breaking Finance news and the latest business articles from AOL. Complete year-end tax forms.

Americas 1 tax preparation provider. Capital Gains Tax Calculator 202223. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

UK Tax. If youre employed then recall that federal taxes have already been taken out of your paychecks. What is the Break Even Analysis Formula.

The aggregate method or the percentage method. Employers tax rates are affected when workers make claims against their account. Financial support from parents or BAföG as well as a scholarship are not included in the income.

This number is quite a bit higher if we look at the average weekly salary coming out to 1438. The flat-rate tax is 2 percent of the salary but it is calculated according to individual wage tax deduction characteristics. Americas 1 tax preparation provider.

Pay attention to wage tax. Employers typically use either of two methods for calculating federal tax withholding on your bonus. If an economy is doing good cyclical unemployment will be at its lowest and will be the highest if the economy growth starts to falter.

In this article we have primarily discussed the simple tax multiplier where the change in taxes only impacts consumption. Corporation Tax Calculator 202223. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

Under tax reform the federal tax rate for withholding on a bonus was lowered to 22 down from the federal income tax rate of 25. Some states do require monthly or annual filings so check the details in your area to be sure. A Break-Even point is a point where the total cost of a product or service is equal to total revenueIt calculates the margin of safety by comparing the value of revenue with covered fixed and variable costs associated with sales.

United States US Tax Brackets Calculator. United States Minimum Wage Calculator. And of course Washington DC.

Each year employers pay unemployment taxes which are deposited into the Unemployment Insurance UI Trust Fund. Other states have a top tax rate but not all states have the same number of income brackets leading up to the top rate. Break Even Analysis Formula Table of Contents Formula.

1 online tax filing solution for self-employed. Typically on a quarterly basis you will need to file state tax returns. After tax that works out to a yearly take-home salary of 49357 or a monthly take-home pay of 4113 according to our New Zealand salary calculator.

Tax Multiplier MPC 1 MPC 1 MPT MPI MPG MPM where. Beverly Bird has been a writer and editor for 30 years covering tax breaks tax preparation and tax law. Beverly has written and edited hundreds of articles for finance and legal sites like GOBankingRates PocketSense LegalZoom and more.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. 1 online tax filing solution for self-employed. For example Hawaii has a top tax rate of 11 and 12 income brackets while Iowa has a top tax rate of 853 and nine income brackets.

Some unemployment benefits are paid out from this fund to workers who have lost their jobs through no fault of their own. You should send 1040 estimated payments to the IRS four times per year. She also worked as a paralegal in the areas of tax law bankruptcy and family law from 1996 to 2010.

File tax returns year-round. However in case the change in tax affects all the components of the GDP then the complex tax multiplier formula has to be used as shown below. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

Self-Employed defined as a return with a Schedule CC-EZ tax form. Use our nanny payroll calculator to help. Generally most employers chose to use the percentage method.

From stock market news to jobs and real estate it can all be found here. Self-Employed defined as a return with a Schedule CC-EZ tax form.

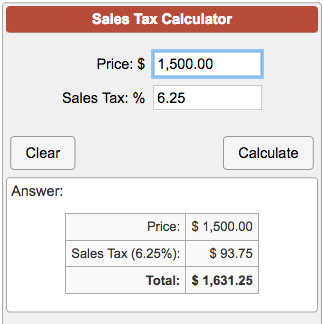

Online Tax Calculator Store 54 Off Www Wtashows Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Income Calculator With Taxes Online 55 Off Www Wtashows Com

Tax Withheld Calculator Flash Sales 57 Off Www Wtashows Com

Tax Calculator For Income Unemployment Taxes Estimate

Federal Income Tax Fit Payroll Tax Calculation Youtube

Tax Return Calculator 2020 Flash Sales 53 Off Pwdnutrition Com

Free Tax Calculator Estimate Your Refund For Free Free 1040 Tax Return Com Inc

Online Tax Calculator Store 54 Off Www Wtashows Com

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Online Tax Calculator Cheap Sale 55 Off Www Wtashows Com

Real Estate Lead Tracking Spreadsheet

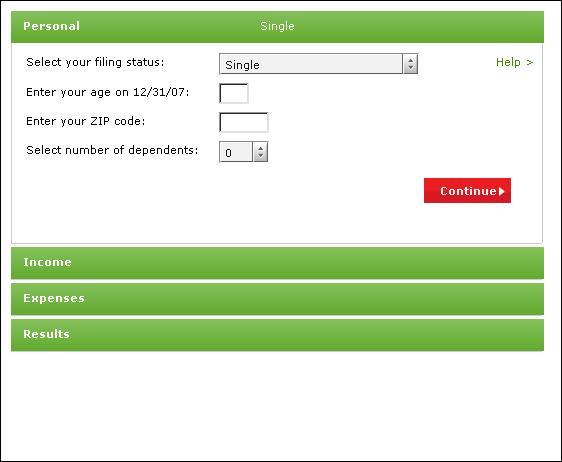

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

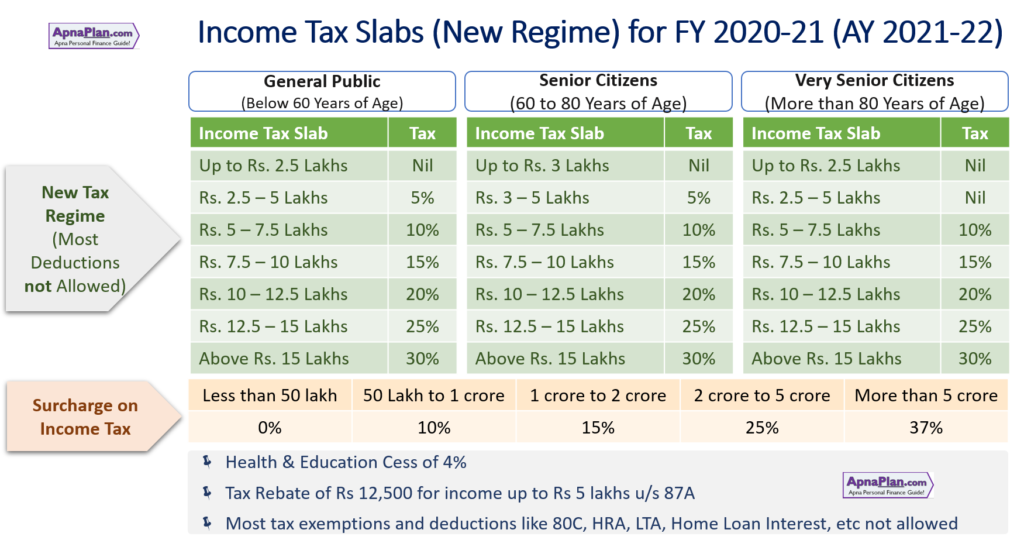

Income Tax Calculator Estimate Your Federal Tax Rate 2019 20

Online Tax Calculator Deals 57 Off Www Wtashows Com

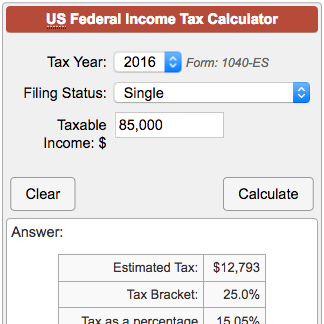

Federal Income Tax Calculator Atlantic Union Bank